Commercial Screen Printing

323113

TD Bank, National Association (DE)

Explore what TD Canada Trust is all about. Learn about our values, initiatives, reporting, news, careers, recent awards, and more.

Sunrise Banks National Association (MN)

Sunrise Banks National Association (MN)

We are focused on creating financial empowerment as a socially-responsible community bank in MN and SD. Learn about our mission & history of community engagement.

STAR Financial Bank (IN)

Salem Five Cents Savings Bank (MA)

Salem Five Cents Savings Bank (MA)

Salem Five Bank provides full-service financial services for the Greater Boston area, including banking, mortgage lending, loans, insurance and investments.

Peapack Private Bank and Trust (NJ)

Explore Peapack Private Bank & Trust's checking and savings accounts tailored to meet your financial needs in the NY Tri-State Area. Open an account today.

First Mid Bank & Trust, National Association (IL)

First Mid Bank & Trust, National Association (IL)

First Mid Bank & Trust offers commercial & personal banking, insurance, & wealth management services throughout Illinois, Missouri, Texas & Wisconsin.

Community National Bank (VT)

ChoiceOne Bank (MI)

CalPrivate Bank (CA)

CalPrivate Bank (CA)

CalPrivate Bank offers customized banking and financial solutions. We also provide commercial loans through various portfolio and government-guaranteed programs.

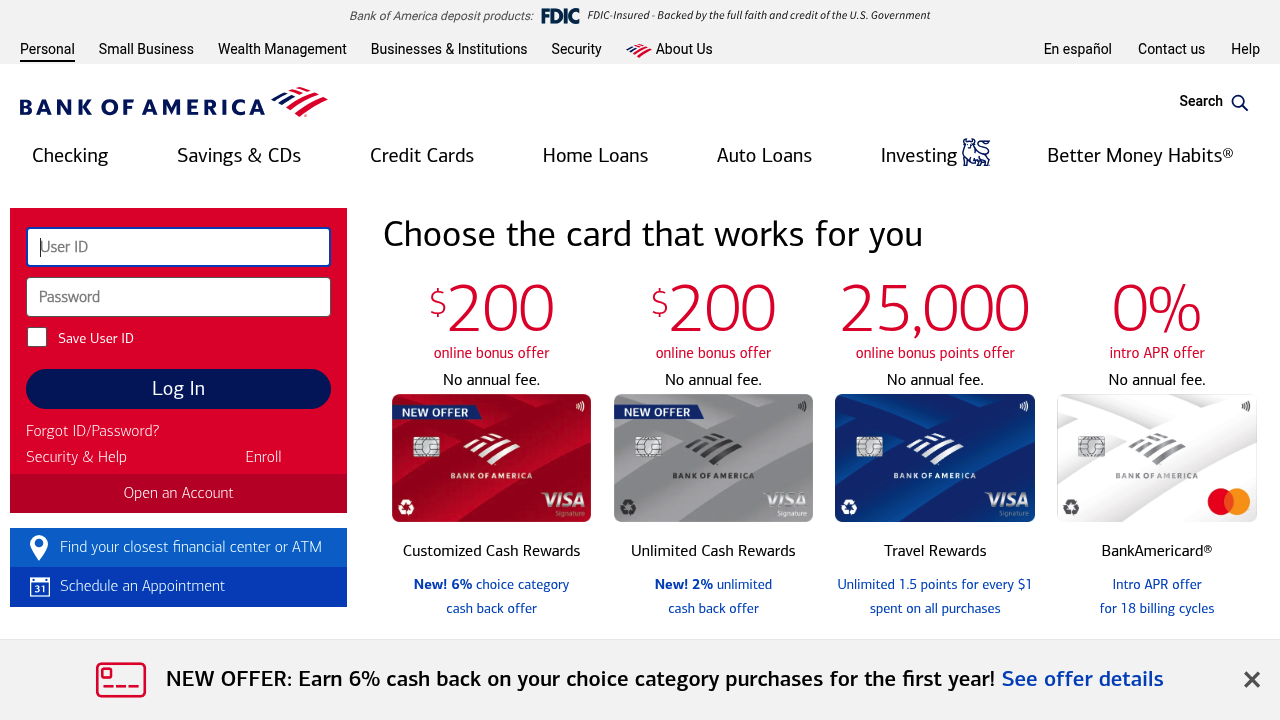

Bank of America, National Association (NC)

Bank of America, National Association (NC)

What would you like the power to do? At Bank of America, our purpose is to help make financial lives better through the power of every connection.

American Momentum Bank (TX)

American Momentum Bank values long-term relationships with business professionals in many industries and exists to serve our clients and communities with practical and intelligent financial solutions.

1st Security Bank of Washington (WA)

1st Security Bank of Washington (WA)

We’re here to help you and your community grow. Join us to see how personal service can make big things happen. Experience better community banking with 1st S

SBA Loans for Commercial Screen Printing: Financing Growth for Print Shops

Introduction

Commercial screen printing businesses provide custom printing services for apparel, signage, promotional products, and more. Whether producing branded T-shirts for local businesses or custom merchandise for national clients, screen printing shops play a vital role in marketing and creative industries. However, running a shop in this competitive sector comes with major financial challenges—expensive equipment, high material costs, labor demands, and the need to keep up with digital technology.

This is where SBA Loans for Commercial Screen Printing can help. Backed by the U.S. Small Business Administration, SBA loans offer affordable financing options with lower down payments, longer repayment terms, and government-backed guarantees. These loans help screen printing shops invest in equipment, manage cash flow, and scale operations to meet growing demand.

In this article, we’ll explore NAICS 323113, common pain points in commercial screen printing, how SBA loans provide solutions, and frequently asked questions from print shop owners.

Industry Overview: NAICS 323113

Commercial Screen Printing (NAICS 323113) businesses specialize in applying designs, logos, and graphics to products using ink and mesh screens. Core products and services include:

- Custom apparel printing (T-shirts, hoodies, uniforms)

- Signage and banners

- Promotional items (tote bags, mugs, hats)

- Specialty printing for events and corporate branding

The industry is tied to marketing, retail, and events. While demand is strong, competition is intense, and staying profitable requires investment in both traditional screen printing equipment and digital printing technology.

Common Pain Points in Screen Printing Financing

Based on Reddit’s r/screenprinting, r/Entrepreneur, and Quora discussions, print shop owners frequently mention these challenges:

- High Equipment Costs – Automatic presses, dryers, exposure units, and digital direct-to-garment printers can cost hundreds of thousands of dollars.

- Inventory & Supplies – Inks, emulsions, squeegees, and blank apparel must be purchased in bulk, straining cash flow.

- Labor Costs – Skilled press operators and designers are essential, adding to payroll expenses.

- Technology Upgrades – Digital printing is reshaping the industry, forcing shops to invest in new equipment to stay competitive.

- Bank Loan Denials – Traditional banks often deny loans due to variable revenues and industry-specific risks.

How SBA Loans Help Commercial Screen Printers

SBA loans provide affordable financing solutions to help screen printing businesses grow and modernize.

SBA 7(a) Loan

- Best for: Working capital, equipment, debt refinancing, or shop expansion.

- Loan size: Up to $5 million.

- Why it helps: Covers equipment upgrades, hiring staff, or expanding services into embroidery or digital printing.

SBA 504 Loan

- Best for: Real estate purchases and large-scale equipment investments.

- Loan size: Up to $5.5 million.

- Why it helps: Ideal for buying a production facility or financing automated screen presses and curing systems.

SBA Microloans

- Best for: Startups or small-scale upgrades.

- Loan size: Up to $50,000.

- Why it helps: Perfect for purchasing starter equipment, marketing campaigns, or initial inventory.

SBA Disaster Loans

- Best for: Shops impacted by natural disasters or economic disruptions.

- Loan size: Up to $2 million.

- Why it helps: Provides recovery funds to replace damaged machinery, inventory, or facilities.

Step-by-Step Guide to Getting an SBA Loan

- Check Eligibility – Must be a U.S.-based, for-profit business with a credit score of at least 650–680.

- Prepare Financial Documents – Include tax returns, balance sheets, profit/loss statements, and client contracts.

- Find an SBA-Approved Lender – Some lenders have experience working with manufacturers and print shops.

- Submit Application – Include a detailed business plan outlining services, market demand, and growth strategy.

- Underwriting & Approval – With SBA guarantees, lenders face less risk. Processing usually takes 30–90 days.

FAQ: SBA Loans for Commercial Screen Printing

Why do traditional banks reject print shop loan applications?

Banks often view screen printing as high-risk due to competitive pressures and equipment-heavy operations. SBA guarantees reduce this risk and improve approval chances.

Can SBA loans cover printing equipment?

Yes. SBA 7(a) and 504 loans can fund presses, dryers, exposure units, and direct-to-garment printers.

What down payment is required?

SBA loans typically require 10–20% down, compared to 25–30% for conventional loans.

Are new screen printing startups eligible?

Yes, with a strong business plan, industry experience, and personal credit history, new shops can qualify for SBA loans.

What repayment terms are available?

- Working capital: Up to 7 years

- Equipment: Up to 10 years

- Real estate: Up to 25 years

Can SBA loans fund shop expansion into digital printing?

Absolutely. Many screen printing shops use SBA loans to invest in hybrid equipment or expand into new printing technologies.

Final Thoughts

The Commercial Screen Printing industry is vibrant but competitive, requiring constant investment in equipment, supplies, and marketing. SBA Loans for Screen Printing Businesses provide affordable, flexible financing that helps shop owners modernize, expand, and stay ahead of the competition.

Whether you’re starting a new shop, upgrading to automated equipment, or expanding into digital printing, SBA financing can provide the capital to grow. Connect with an SBA-approved lender today and explore the options that fit your vision.

Filters

Tags

#Preferred Lenders Program

#SBA Express Program

#Existing or more than 2 years old

#Startup

#Loan Funds will Open Business

#Fixed Rates Startup

#Change of Ownership

#New Business or 2 years or less

#7a General

#Variable Rates

#Fixed Rates

#Standard Asset Base Working Capital Line of Credit (CAPLine)

#International Trade Loans

#Export Express

#7a with WCP

#Contract Loan Line of Credit (CAPLine)

#7a with EWCP

#Unanswered

#Preferred Lenders with WCP

#Preferred Lenders with EWCP

#Seasonal Line of Credit (CAPLine)