Dental Laboratories

339116

First Resource Bank (MN)

First Resource Bank (MN)

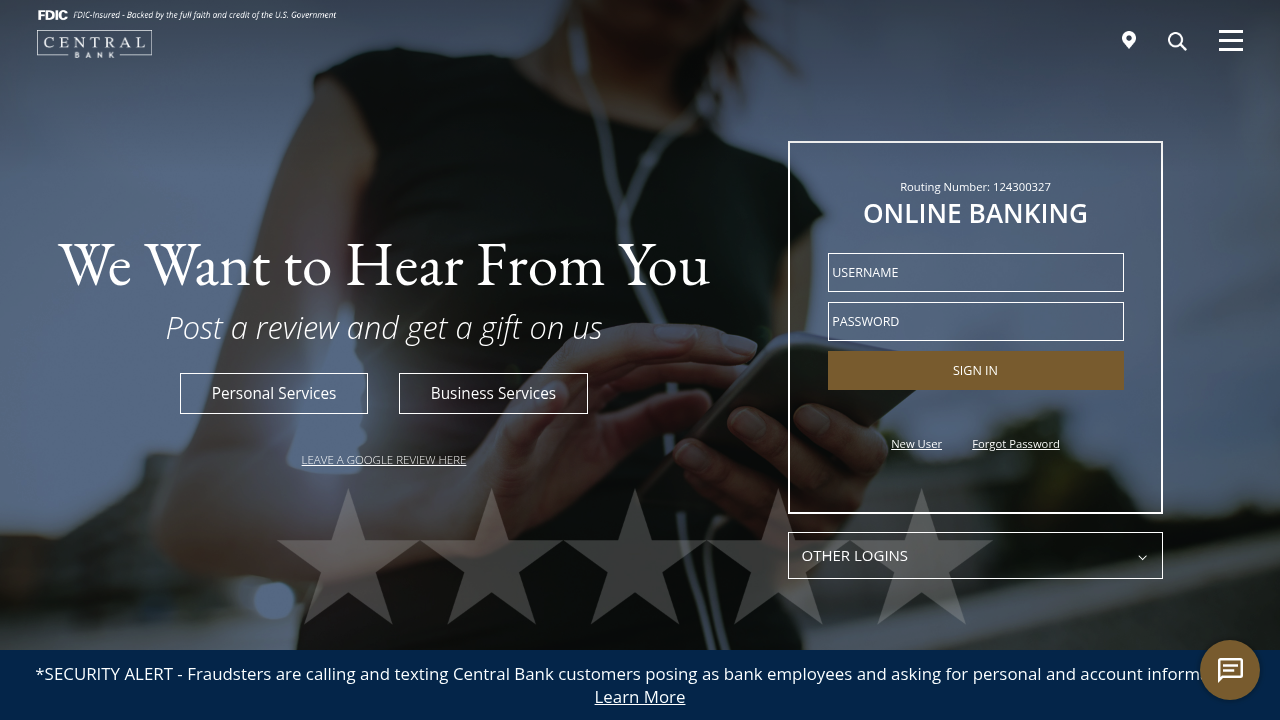

Creative Banking Trusted Partners When You Need Us Most OnPoint HOA Financial Bank Transitions Made EasyBanking Solutions Made Every Day Cash Management University An Education of Business Solutions It’s what we do Our team of financial experts are here to make your dreams a reality. First Resource Bank is built on Three Core Values: Providing […]

First Financial Bank (AR)

First Financial Bank (AR)

First Financial Bank will be the leading provider of financial services in our markets; dedicated to growth by consistently exceeding the expectations of our customers while treating our employees fairly and respectfully.

Community National Bank (VT)

Central Bank (UT)

CalPrivate Bank (CA)

CalPrivate Bank (CA)

CalPrivate Bank offers customized banking and financial solutions. We also provide commercial loans through various portfolio and government-guaranteed programs.

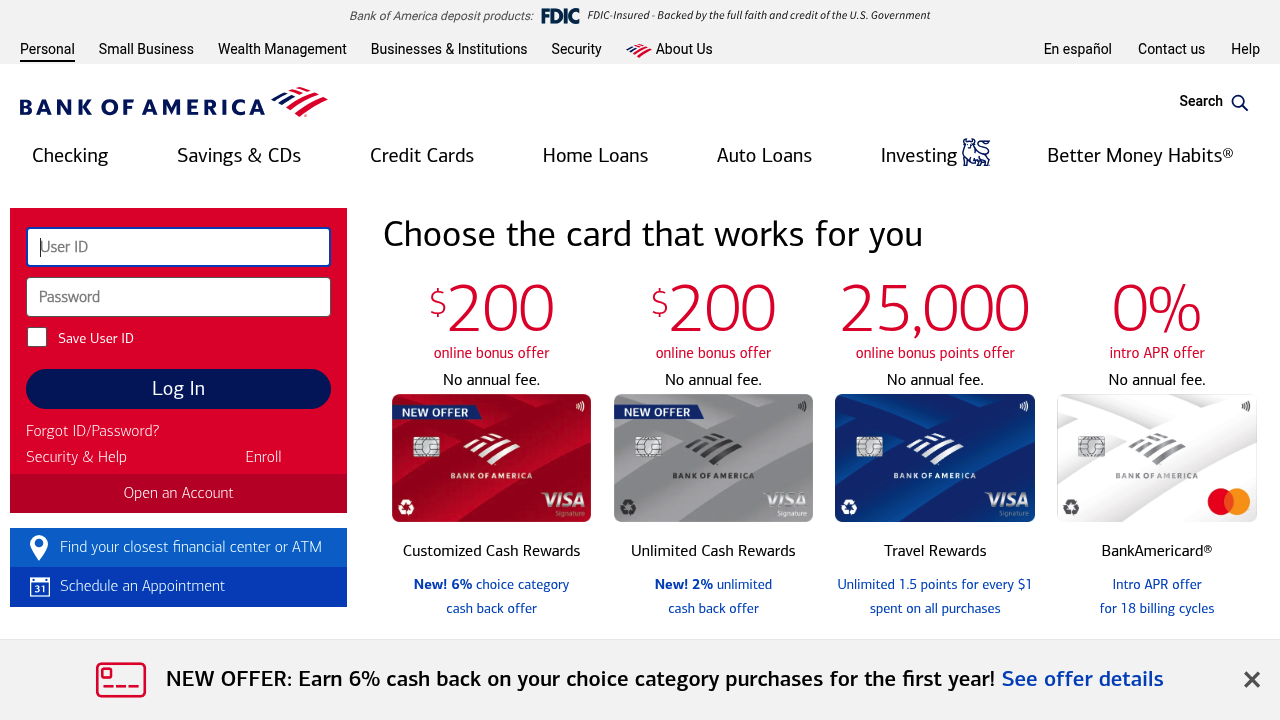

Bank of America, National Association (NC)

Bank of America, National Association (NC)

What would you like the power to do? At Bank of America, our purpose is to help make financial lives better through the power of every connection.

SBA Loans for Dental Laboratories: Financing Growth in Oral Health Manufacturing

Introduction

Dental laboratories manufacture custom dental prosthetics, crowns, bridges, dentures, and orthodontic devices that are critical to patient care. Classified under NAICS 339116 – Dental Laboratories, this sector provides vital support to dentists, orthodontists, and oral surgeons by producing high-quality dental appliances that improve both function and aesthetics. With rising demand for cosmetic dentistry, aging populations, and advancements in digital imaging and 3D printing, dental labs are experiencing growth but face challenges including technology costs, labor shortages, and fluctuating material prices.

This is where SBA Loans for Dental Laboratories can provide essential support. Backed by the U.S. Small Business Administration, SBA loans offer longer repayment terms, lower down payments, and government-backed guarantees. These loans help labs purchase advanced equipment, hire skilled technicians, expand facilities, and stabilize cash flow while scaling operations.

In this article, we’ll explore NAICS 339116, the financial challenges dental labs face, how SBA loans provide solutions, and answers to frequently asked questions from lab owners.

Industry Overview: NAICS 339116

Dental Laboratories (NAICS 339116) include businesses that manufacture:

- Crowns, bridges, and dental implants

- Dentures and partial dentures

- Orthodontic retainers and aligners

- 3D-printed dental prosthetics

- Custom devices for oral surgery and restorations

This industry is both skill- and technology-driven, requiring investment in precision equipment and highly trained staff.

Common Pain Points in Dental Laboratory Financing

From Reddit’s r/dentistry, r/smallbusiness, and Quora discussions, dental lab owners often highlight these challenges:

- High Equipment Costs – 3D printers, milling machines, and scanners require major investment.

- Material Price Volatility – Metals, ceramics, and resins fluctuate in cost.

- Labor Shortages – Recruiting skilled dental technicians is difficult and costly.

- Technology Integration – Digital workflows and CAD/CAM systems are essential but expensive.

- Cash Flow Strain – Payments from dental offices can lag behind production expenses.

How SBA Loans Help Dental Laboratories

SBA financing provides affordable, flexible capital that helps labs modernize, expand, and remain competitive in the fast-changing dental industry.

SBA 7(a) Loan

- Best for: Working capital, payroll, or material purchases

- Loan size: Up to $5 million

- Why it helps: Provides liquidity to cover salaries, supplies, and day-to-day operations

SBA 504 Loan

- Best for: Facilities, advanced dental equipment, or lab expansions

- Loan size: Up to $5.5 million

- Why it helps: Ideal for upgrading labs with CAD/CAM systems, 3D printers, and milling units

SBA Microloans

- Best for: Small or startup dental labs

- Loan size: Up to $50,000

- Why it helps: Useful for small-scale equipment, software, or marketing

SBA Disaster Loans

- Best for: Labs impacted by natural disasters or economic downturns

- Loan size: Up to $2 million

- Why it helps: Provides recovery funds for facility repairs, lost contracts, or technology replacement

Step-by-Step Guide to Getting an SBA Loan

- Check Eligibility – Must be a U.S.-based, for-profit dental lab with good personal credit (typically 650+)

- Prepare Financial Documents – Include tax returns, P&L statements, material invoices, and equipment quotes

- Find an SBA-Approved Lender – Some lenders specialize in healthcare and dental-related industries

- Submit Application – Provide a business plan highlighting client base, production capacity, and technology adoption

- Underwriting & Approval – SBA guarantees reduce lender risk. Approval usually takes 30–90 days

FAQ: SBA Loans for Dental Laboratories

Why do banks often deny loans to dental labs?

Banks may view labs as risky due to high equipment costs, reliance on dental practices, and long payment cycles. SBA guarantees reduce this risk and improve approval chances.

Can SBA loans finance 3D printing and CAD/CAM systems?

Yes. SBA 7(a) and 504 loans can fund advanced dental technology and digital workflow integration.

What down payment is required?

SBA loans typically require 10–20% down, compared to 25–30% for conventional financing.

Are startup dental labs eligible?

Yes. Entrepreneurs with dental technician expertise and client relationships may qualify for SBA microloans or 7(a) financing.

What repayment terms are available?

- Working capital: Up to 7 years

- Equipment/facilities: Up to 10 years

- Real estate/labs: Up to 25 years

Can SBA loans support marketing and client acquisition?

Absolutely. Many dental labs use SBA financing to fund outreach, partnerships with dental practices, and trade show participation.

Final Thoughts

The Dental Laboratories industry is critical to oral healthcare but faces financial hurdles tied to equipment, staffing, and technology adoption. SBA Loans for Dental Labs provide affordable, flexible financing to modernize production, expand client services, and maintain competitive advantage.

Whether you run a small local lab or a large dental manufacturing facility, SBA financing can provide the resources you need. Connect with an SBA-approved lender today and explore your funding options under NAICS 339116.

Filters

Tags

#Preferred Lenders Program

#SBA Express Program

#Existing or more than 2 years old

#Startup

#Loan Funds will Open Business

#Fixed Rates Startup

#Change of Ownership

#New Business or 2 years or less

#7a General

#Variable Rates

#Fixed Rates

#Standard Asset Base Working Capital Line of Credit (CAPLine)

#International Trade Loans

#Export Express

#7a with WCP

#Contract Loan Line of Credit (CAPLine)

#7a with EWCP

#Unanswered

#Preferred Lenders with WCP

#Preferred Lenders with EWCP

#Seasonal Line of Credit (CAPLine)