Educational Support Services

611710

St. Mary's CU (MA)

St. Mary's CU (MA)

Over 100 years of local and trusted banking products and services for our community.

Scale Bank (MN)

Scale Bank (MN)

Scale Bank is ready to help you with expert banking solutions including small business loans, equipment financing and more!

OakStar Bank (MO)

OakStar Bank in Missouri, Kansas, and Colorado offers checking and savings accounts, CDs, personal loans, auto loans, mortgages, and more. Explore today.

Northwest Bank (PA)

iTHINK Financial CU (FL)

First Port City Bank (FL)

First Port City Bank (FL)

First Port City Bank is your trusted bank for personal and business checking, savings, mortgages, loans and more with branch locations in Florida and Georgia.

Farmers State Bank (IA)

Community National Bank (VT)

Commonwealth Business Bank (CA)

CBB Bank is a full-service commercial bank that combines a wide range of financial products with personalized services.

Commerce Bank (MO)

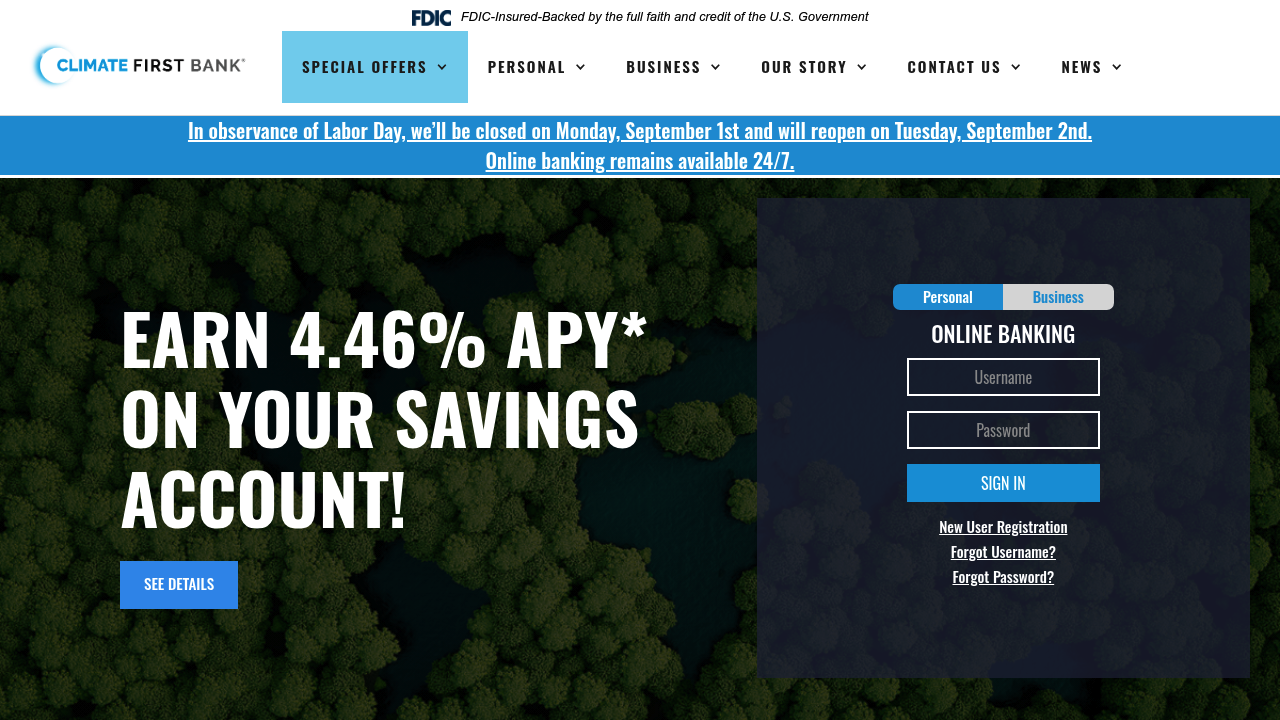

Climate First Bank (FL)

Climate First Bank (FL)

The world's first FDIC-insured community bank dedicated to the environment and sustainability. Climate friendly personal and business banking solutions. Open an account today.

SBA Loans for Educational Support Services: Financing Growth in Learning and Development

Introduction

Educational support service providers offer a wide range of services that complement and enhance learning, from testing and tutoring to curriculum consulting and student exchange programs. Classified under NAICS 611710 – Educational Support Services, this industry supports schools, universities, training centers, and individual learners. With increasing demand for supplemental learning and workforce development, the sector is expanding—but businesses face challenges such as high technology costs, staffing expenses, seasonal enrollment cycles, and the need to adapt to digital learning trends.

This is where SBA Loans for Educational Support Service Providers can help. Backed by the U.S. Small Business Administration, SBA loans provide lower down payments, longer repayment terms, and government-backed guarantees. These loans help businesses invest in technology, expand programs, hire staff, and maintain cash flow during peak and off-peak enrollment periods.

In this article, we’ll explore NAICS 611710, the financial challenges educational service providers face, how SBA loans provide solutions, and answers to frequently asked questions from owners and operators in this space.

Industry Overview: NAICS 611710

Educational Support Services (NAICS 611710) businesses provide:

- Standardized test preparation services

- Tutoring and academic enrichment programs

- Curriculum design and consulting

- Student exchange and study abroad programs

- Professional development and continuing education support

This industry is highly adaptable, serving students, educators, and businesses seeking training solutions.

Common Pain Points in Educational Support Financing

From Reddit’s r/Teachers, r/smallbusiness, and Quora discussions, operators often highlight:

- Technology Investment – Online platforms, learning management systems, and virtual classrooms require significant funding.

- Staffing Costs – Recruiting qualified tutors and educators increases payroll expenses.

- Enrollment Cycles – Demand fluctuates with school calendars, creating seasonal cash flow challenges.

- Marketing Expenses – Attracting students and institutions requires constant investment in outreach.

- Competition – Competing with both local providers and large online education platforms.

How SBA Loans Help Educational Support Service Providers

SBA financing provides affordable, flexible capital that enables providers to expand services, invest in technology, and stabilize operations.

SBA 7(a) Loan

- Best for: Working capital, payroll, or marketing campaigns

- Loan size: Up to $5 million

- Why it helps: Provides liquidity to cover operational expenses during slow enrollment periods

SBA 504 Loan

- Best for: Facilities, technology infrastructure, or long-term equipment

- Loan size: Up to $5.5 million

- Why it helps: Ideal for upgrading classrooms, office space, or IT systems

SBA Microloans

- Best for: Startup or small tutoring and education service firms

- Loan size: Up to $50,000

- Why it helps: Useful for launching new programs, purchasing laptops, or developing course materials

SBA Disaster Loans

- Best for: Firms impacted by natural disasters, school closures, or economic downturns

- Loan size: Up to $2 million

- Why it helps: Provides recovery funds for lost revenue or damaged facilities

Step-by-Step Guide to Getting an SBA Loan

- Check Eligibility – Must be a U.S.-based, for-profit educational support business with good personal credit (typically 650+)

- Prepare Financial Documents – Include tax returns, P&L statements, student contracts, and program outlines

- Find an SBA-Approved Lender – Some lenders specialize in education and service-based financing

- Submit Application – Provide a business plan highlighting services, partnerships, and growth strategy

- Underwriting & Approval – SBA guarantees reduce lender risk. Approval usually takes 30–90 days

FAQ: SBA Loans for Educational Support Services

Why do banks often deny loans to education service businesses?

Banks may view them as risky due to seasonal demand, reliance on contracts, and competition from larger providers. SBA guarantees reduce this risk and improve approval chances.

Can SBA loans finance online learning platforms?

Yes. SBA 7(a) and 504 loans can fund digital infrastructure, software, and learning management systems.

What down payment is required?

SBA loans usually require 10–20% down, compared to 25–30% for conventional loans.

Are startup tutoring or enrichment services eligible?

Yes. Entrepreneurs with education experience and a clear business plan may qualify for SBA microloans or 7(a) financing.

What repayment terms are available?

- Working capital: Up to 7 years

- Equipment/facilities: Up to 10 years

- Real estate/classrooms: Up to 25 years

Can SBA loans support certification and professional development programs?

Absolutely. Many firms use SBA financing to expand into workforce training, exam preparation, and continuing education.

Final Thoughts

The Educational Support Services industry is growing quickly as students, schools, and professionals seek supplemental learning. However, businesses face financial hurdles tied to staffing, technology, and seasonal revenue. SBA Loans for Educational Service Providers offer affordable, flexible financing to expand operations, enhance digital offerings, and remain competitive.

Whether you run a tutoring center, curriculum consulting firm, or professional development provider, SBA financing can give you the resources to thrive. Connect with an SBA-approved lender today and explore your funding options under NAICS 611710.

Filters

Tags

#Preferred Lenders Program

#SBA Express Program

#Existing or more than 2 years old

#Startup

#Loan Funds will Open Business

#Fixed Rates Startup

#Change of Ownership

#New Business or 2 years or less

#7a General

#Variable Rates

#Fixed Rates

#Standard Asset Base Working Capital Line of Credit (CAPLine)

#International Trade Loans

#Export Express

#7a with WCP

#Contract Loan Line of Credit (CAPLine)

#7a with EWCP

#Unanswered

#Preferred Lenders with WCP

#Preferred Lenders with EWCP

#Seasonal Line of Credit (CAPLine)