Residential Remodelers

236118

Stock Yards Bank & Trust Company

Are you looking for a reliable bank that puts your needs first? Look no further than Stock Yards Bank & Trust Company in Kentucky! With a long-standing commitment to exceptional customer service and innovative banking solutions, Stock Yards is here to support your financial journey.

St. Mary's CU (MA)

St. Mary's CU (MA)

Over 100 years of local and trusted banking products and services for our community.

St. Mary's Bank (NH)

St. Mary's Bank (NH)

Discover personal and business banking from St. Mary’s Bank. As America’s first credit union, we proudly serve New Hampshire communities since 1908.

Southern Bancorp Bank (AR)

Southern Bancorp Bank (AR)

Southern Bancorp combines banking and lending services with unique financial development tools to help families and communities grow stronger.

Shoreham Bank (RI)

Shoreham Bank offers Retail Banking, Mortgages, Home Equity Loans, Auto Loans, and much more. Providing our customers with convenience and reliable service since 1959.

Salem Five Cents Savings Bank (MA)

Salem Five Cents Savings Bank (MA)

Salem Five Bank provides full-service financial services for the Greater Boston area, including banking, mortgage lending, loans, insurance and investments.

PS Bank (PA)

PS Bank (PA)

Bank better with PS Bank in PA. Enjoy a variety of personal and business checking and savings accounts, mortgages, and great interest rates. Join today.

Peoples Bank (OH)

Peoples Bank (OH)

Peoples Bank is a Small Business Administration Preferred Lender with 30 years SBA Lending Experience. Small Business Loans tailored for you.

Peapack Private Bank and Trust (NJ)

Explore Peapack Private Bank & Trust's checking and savings accounts tailored to meet your financial needs in the NY Tri-State Area. Open an account today.

Oconee State Bank (GA)

Oconee State Bank (GA)

One of the strengths of the bank, is its knowledge of its customers and focus on serving and taking care of its employees, customers, and community.

North State Bank (NC)

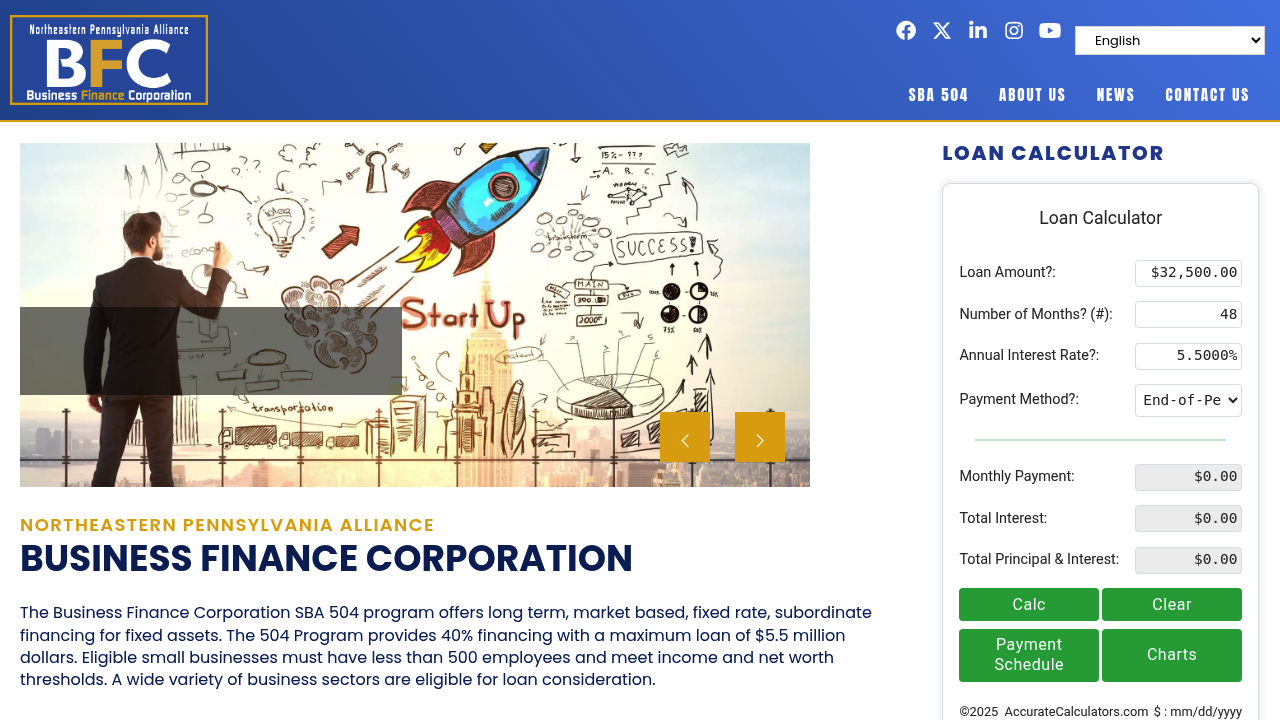

NEPA Alliance Business Finance Corporation (PA)

NEPA Alliance Business Finance Corporation (PA)

Serving seven counties of Northeastern Pennsylvania including Carbon, Lackawanna, Luzerne, Monroe, Pike, Schuylkill and Wayne.

SBA Loans for Residential Remodelers: Financing Growth in Home Renovation Services

Introduction

Residential remodelers play a vital role in upgrading, repairing, and transforming homes across the U.S. Classified under NAICS 236118 – Residential Remodelers, this sector includes contractors specializing in kitchen and bath remodels, additions, basement finishing, exterior upgrades, and whole-home renovations. While the remodeling industry is thriving due to strong homeowner demand, remodelers face financial challenges such as fluctuating material costs, payroll, equipment purchases, and cash flow gaps caused by project-based billing.

This is where SBA Loans for Residential Remodelers provide critical support. Backed by the U.S. Small Business Administration, SBA loans offer affordable financing with longer repayment terms, lower down payments, and government-backed guarantees. These loans help contractors purchase materials, manage payroll, cover insurance, and expand into larger projects.

In this article, we’ll explore NAICS 236118, the challenges residential remodelers face, how SBA loans can help, and answers to frequently asked questions from contractors in the remodeling industry.

Industry Overview: NAICS 236118

Residential Remodelers (NAICS 236118) provide a wide range of home improvement services, including:

- Kitchen and bathroom remodeling

- Room additions and basement finishing

- Exterior renovations, roofing, and siding upgrades

- Energy efficiency and green building upgrades

- Whole-home renovation projects

The remodeling sector continues to grow as homeowners invest in updating older housing stock and improving property value. However, project delays, rising costs, and competition put financial strain on contractors.

Common Pain Points in Residential Remodeling Financing

From Reddit’s r/HomeImprovement, r/Contractors, and Quora discussions, remodelers often share these financial hurdles:

- High Material Costs – Lumber, steel, fixtures, and finishing materials fluctuate in price.

- Labor Shortages – Recruiting and retaining skilled workers drives up payroll costs.

- Project-Based Cash Flow – Payments are often delayed until project milestones are met.

- Equipment & Tools – Vehicles, power tools, and safety gear require ongoing investment.

- Insurance & Licensing – Contractors must maintain costly liability insurance, bonding, and licenses.

How SBA Loans Help Residential Remodelers

SBA loans provide contractors with flexible capital to stabilize operations, purchase equipment, and take on larger projects with confidence.

SBA 7(a) Loan

- Best for: Working capital, payroll, materials, or debt refinancing.

- Loan size: Up to $5 million.

- Why it helps: Covers everyday expenses like material purchases, insurance, and marketing campaigns.

SBA 504 Loan

- Best for: Real estate and major equipment purchases.

- Loan size: Up to $5.5 million.

- Why it helps: Ideal for acquiring workshops, storage facilities, or heavy-duty construction equipment.

SBA Microloans

- Best for: Small or startup remodeling businesses.

- Loan size: Up to $50,000.

- Why it helps: Useful for buying tools, safety equipment, or covering licensing and permit fees.

SBA Disaster Loans

- Best for: Recovery from natural disasters or project disruptions.

- Loan size: Up to $2 million.

- Why it helps: Provides funds to replace equipment, repair facilities, or cover lost revenue after disruptions.

Step-by-Step Guide to Getting an SBA Loan

- Check Eligibility – Must be a U.S.-based, for-profit contracting business with good personal credit (typically 650+).

- Prepare Financial Documents – Include tax returns, P&L statements, job contracts, and payroll records.

- Find an SBA-Approved Lender – Some lenders specialize in construction and remodeling financing.

- Submit Application – Provide a detailed business plan with project pipeline, market demand, and growth projections.

- Underwriting & Approval – SBA guarantees reduce lender risk. Processing usually takes 30–90 days.

FAQ: SBA Loans for Residential Remodelers

Why do banks often deny loans to remodeling contractors?

Banks consider remodeling contractors high-risk due to project-based revenue, material cost fluctuations, and cash flow gaps. SBA guarantees reduce this risk, improving approval chances.

Can SBA loans fund trucks, tools, and equipment?

Yes. SBA 7(a) and 504 loans can finance construction vehicles, power tools, and safety equipment.

What down payment is required?

SBA loans typically require 10–20% down, compared to 25–30% with conventional loans.

Are startup remodelers eligible?

Yes. Startups with contracting experience, proper licensing, and a strong business plan can qualify for SBA financing.

What repayment terms are available?

- Working capital: Up to 7 years

- Equipment: Up to 10 years

- Real estate: Up to 25 years

Can SBA loans help expand into larger projects?

Absolutely. Many remodelers use SBA loans to take on bigger jobs, hire more staff, and grow their capacity.

Final Thoughts

The Residential Remodelers sector is booming as homeowners invest in renovations and upgrades, but managing costs and cash flow is a challenge. SBA Loans for Remodelers provide affordable, flexible capital to cover materials, payroll, and equipment while enabling contractors to expand operations.

Whether you’re a small remodeler focusing on kitchens and baths or a growing contractor taking on large-scale renovations, SBA financing can provide the resources to succeed. Connect with an SBA-approved lender today and explore your options for funding growth in residential remo

Filters

Tags

#Preferred Lenders Program

#SBA Express Program

#Existing or more than 2 years old

#Startup

#Loan Funds will Open Business

#Fixed Rates Startup

#Change of Ownership

#New Business or 2 years or less

#7a General

#Variable Rates

#Fixed Rates

#Standard Asset Base Working Capital Line of Credit (CAPLine)

#International Trade Loans

#Export Express

#7a with WCP

#Contract Loan Line of Credit (CAPLine)

#7a with EWCP

#Unanswered

#Preferred Lenders with WCP

#Preferred Lenders with EWCP

#Seasonal Line of Credit (CAPLine)