Sports and Recreation Instruction

611620

The Bancorp Bank National Association (SD)

The Bancorp Bank National Association (SD)

For over 20 years, The Bancorp has been providing nonbank companies with the people, processes and banking technology that are essential in meeting their individual needs

Southwestern National Bank (TX)

Shoreham Bank (RI)

Shoreham Bank offers Retail Banking, Mortgages, Home Equity Loans, Auto Loans, and much more. Providing our customers with convenience and reliable service since 1959.

Peoples Bank (OH)

Peoples Bank (OH)

Peoples Bank is a Small Business Administration Preferred Lender with 30 years SBA Lending Experience. Small Business Loans tailored for you.

North State Bank (NC)

Heritage Bank Inc (KY)

FNBC Bank (AR)

First-Citizens Bank & Trust Company (NC)

First-Citizens Bank & Trust Company (NC)

First Citizens provides a full range of banking products and services to meet your individual or business financial needs. Learn more about our products and services such as checking, savings, credit cards, mortgages and investments.

First Resource Bank (MN)

First Resource Bank (MN)

Creative Banking Trusted Partners When You Need Us Most OnPoint HOA Financial Bank Transitions Made EasyBanking Solutions Made Every Day Cash Management University An Education of Business Solutions It’s what we do Our team of financial experts are here to make your dreams a reality. First Resource Bank is built on Three Core Values: Providing […]

First Port City Bank (FL)

First Port City Bank (FL)

First Port City Bank is your trusted bank for personal and business checking, savings, mortgages, loans and more with branch locations in Florida and Georgia.

First Mid Bank & Trust, National Association (IL)

First Mid Bank & Trust, National Association (IL)

First Mid Bank & Trust offers commercial & personal banking, insurance, & wealth management services throughout Illinois, Missouri, Texas & Wisconsin.

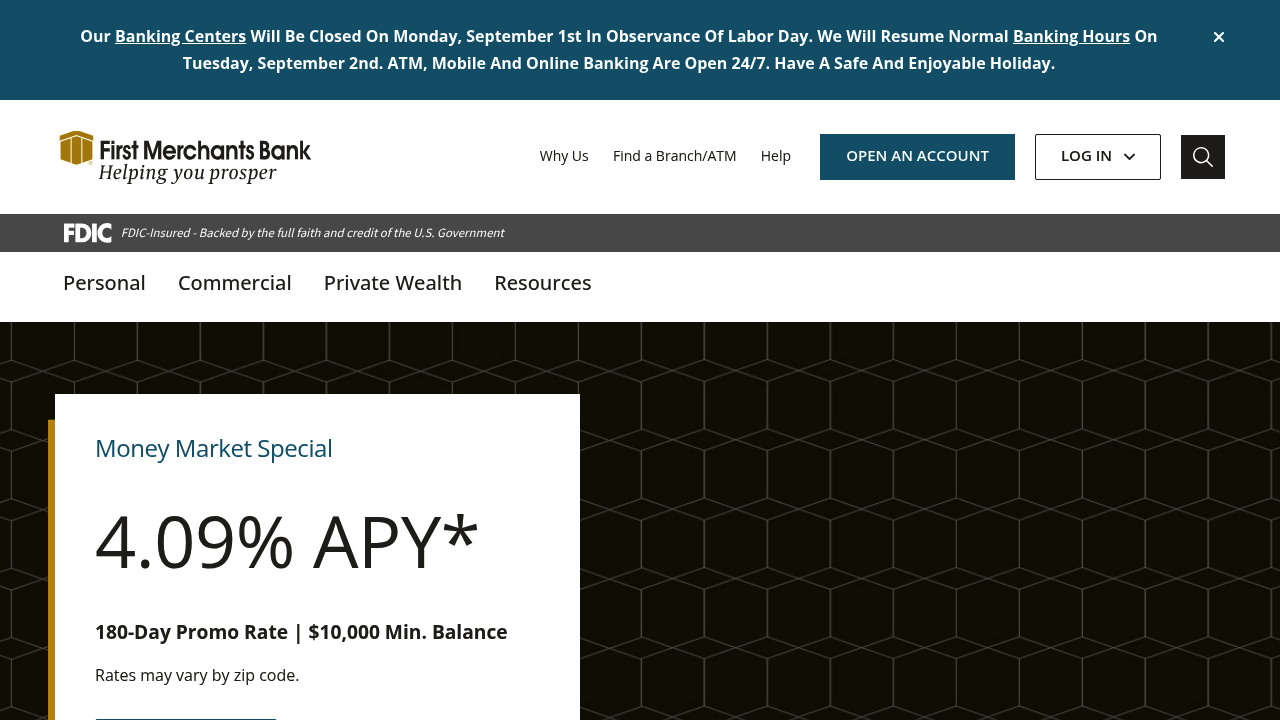

First Merchants Bank (IN)

SBA Loans for Sports and Recreation Instruction: Financing Growth in Training and Fitness Services

Introduction

Sports and recreation instructors play a vital role in helping individuals and communities stay active, healthy, and skilled. Classified under NAICS 611620 – Sports and Recreation Instruction, this sector includes businesses and professionals offering training in swimming, tennis, golf, martial arts, fitness, dance, and other recreational activities. While demand for health and wellness services continues to grow, sports and recreation instruction businesses face financial challenges such as facility costs, equipment investments, seasonal demand, and marketing expenses.

This is where SBA Loans for Sports and Recreation Instructors provide valuable support. Backed by the U.S. Small Business Administration, SBA loans offer longer repayment terms, lower down payments, and government-backed guarantees. These loans help instructors and facility owners purchase equipment, rent or buy facilities, hire staff, and stabilize cash flow while expanding their programs.

In this article, we’ll explore NAICS 611620, the common financial hurdles instruction businesses face, how SBA loans provide solutions, and answers to frequently asked questions from sports and recreation entrepreneurs.

Industry Overview: NAICS 611620

Sports and Recreation Instruction (NAICS 611620) covers a wide variety of training and teaching services, including:

- Swimming and aquatics instruction

- Tennis and golf lessons

- Martial arts and self-defense training

- Dance and movement programs

- Fitness bootcamps and personal training

- Recreational skills training (archery, rock climbing, skating, etc.)

While the industry benefits from growing interest in wellness and youth sports, it often struggles with seasonal fluctuations and the need for constant reinvestment in facilities and equipment.

Common Pain Points in Sports and Recreation Financing

From Reddit’s r/fitnessbiz, r/smallbusiness, and Quora discussions, sports and recreation professionals often cite these challenges:

- Facility Costs – Renting or maintaining gyms, studios, pools, or outdoor spaces requires ongoing investment.

- Equipment Expenses – Sports gear, mats, weights, training machines, and safety equipment are expensive to purchase and maintain.

- Seasonal Demand – Many programs see spikes during summer or school breaks, but slower months create cash flow issues.

- Marketing & Client Acquisition – Instructors often rely on advertising, social media, and local partnerships to attract clients.

- Staffing – Hiring certified coaches, instructors, or part-time staff adds payroll pressure.

How SBA Loans Help Sports and Recreation Instruction Businesses

SBA loans provide affordable financing that enables training and fitness businesses to grow sustainably, improve offerings, and build long-term success.

SBA 7(a) Loan

- Best for: Working capital, payroll, marketing, or debt refinancing.

- Loan size: Up to $5 million.

- Why it helps: Provides flexible funding for everyday expenses, staff salaries, and promotional campaigns.

SBA 504 Loan

- Best for: Real estate and large equipment purchases.

- Loan size: Up to $5.5 million.

- Why it helps: Ideal for building or purchasing training centers, gyms, or specialized sports facilities.

SBA Microloans

- Best for: Small or startup instruction businesses.

- Loan size: Up to $50,000.

- Why it helps: Useful for purchasing gear, mats, or launching a marketing initiative.

SBA Disaster Loans

- Best for: Instructors or facilities impacted by natural disasters or unexpected closures.

- Loan size: Up to $2 million.

- Why it helps: Provides recovery funding for damaged facilities, lost income, or equipment replacement.

Step-by-Step Guide to Getting an SBA Loan

- Check Eligibility – Must be a U.S.-based, for-profit business with good personal credit (typically 650+).

- Prepare Financial Documents – Include tax returns, P&L statements, membership contracts, and payroll records.

- Find an SBA-Approved Lender – Some lenders specialize in fitness and recreational services financing.

- Submit Application – Provide a business plan highlighting instruction programs, target markets, and growth goals.

- Underwriting & Approval – SBA guarantees reduce lender risk. Processing typically takes 30–90 days.

FAQ: SBA Loans for Sports and Recreation Instructors

Why do banks often deny loans to instruction businesses?

Banks may see these businesses as risky due to seasonal demand and reliance on memberships or class fees. SBA guarantees reduce this risk and improve approval odds.

Can SBA loans finance gym or sports equipment?

Yes. SBA 7(a) and 504 loans can fund mats, weights, machines, safety gear, and facility upgrades.

What down payment is required?

SBA loans typically require 10–20% down, compared to 25–30% for conventional loans.

Are startup instructors eligible?

Yes. New instructors with certifications and a solid business plan can qualify for SBA financing.

What repayment terms are available?

- Working capital: Up to 7 years

- Equipment: Up to 10 years

- Real estate/facilities: Up to 25 years

Can SBA loans support program expansion?

Absolutely. Many instructors use SBA loans to expand their offerings—adding new classes, hiring staff, or opening additional training facilities.

Final Thoughts

The Sports and Recreation Instruction industry is growing as people prioritize health, fitness, and skill development. SBA Loans for Instruction Businesses provide affordable, flexible financing to stabilize operations, upgrade equipment, and expand training opportunities.

Whether you’re a personal trainer opening your first studio, a martial arts instructor upgrading facilities, or a multi-sport academy expanding programs, SBA financing can provide the resources you need. Connect with an SBA-approved lender today and explore your funding options for success in the sports and recreat

Filters

Tags

#Preferred Lenders Program

#SBA Express Program

#Existing or more than 2 years old

#Startup

#Loan Funds will Open Business

#Fixed Rates Startup

#Change of Ownership

#New Business or 2 years or less

#7a General

#Variable Rates

#Fixed Rates

#Standard Asset Base Working Capital Line of Credit (CAPLine)

#International Trade Loans

#Export Express

#7a with WCP

#Contract Loan Line of Credit (CAPLine)

#7a with EWCP

#Unanswered

#Preferred Lenders with WCP

#Preferred Lenders with EWCP

#Seasonal Line of Credit (CAPLine)