Automobile and Other Motor Vehicle Merchant Wholesalers

423110

SBA Loans for Automobile and Other Motor Vehicle Merchant Wholesalers: Financing Growth in Vehicle Distribution

Introduction

Automobile and motor vehicle wholesalers are the backbone of the auto industry’s supply chain, connecting manufacturers with dealerships and fleets. Classified under NAICS 423110 – Automobile and Other Motor Vehicle Merchant Wholesalers, this sector includes businesses that distribute new and used cars, trucks, SUVs, and specialty vehicles to retailers and end-users. While the industry benefits from strong consumer demand, wholesalers face financial challenges such as high inventory costs, fluctuating vehicle values, logistics, and regulatory compliance.

This is where SBA Loans for Auto Wholesalers can make a major impact. Backed by the U.S. Small Business Administration, SBA loans provide affordable financing with longer repayment terms, lower down payments, and government-backed guarantees. These loans help wholesalers purchase inventory, expand warehouses, improve logistics, and manage working capital effectively.

In this article, we’ll explore NAICS 423110, the financial hurdles auto wholesalers face, how SBA loans provide solutions, and answers to frequently asked questions from motor vehicle distribution entrepreneurs.

Industry Overview: NAICS 423110

Automobile and Other Motor Vehicle Merchant Wholesalers (NAICS 423110) include businesses that focus on:

- New car and truck wholesaling

- Used motor vehicle distribution

- Fleet vehicle sales and leasing

- Specialty vehicles such as buses, vans, and heavy-duty trucks

- International vehicle imports and exports

These businesses require substantial investment in inventory, storage, and transportation to remain competitive in the wholesale market.

Common Pain Points in Vehicle Wholesaling Financing

From Reddit’s r/Entrepreneur, r/autoindustry, and Quora discussions, wholesalers often mention these struggles:

- High Inventory Costs – Purchasing and holding vehicles ties up large amounts of capital.

- Market Volatility – Vehicle values fluctuate with demand, supply shortages, and economic conditions.

- Transportation & Logistics – Delivering vehicles to dealerships requires specialized carriers and adds to overhead.

- Insurance & Compliance – Vehicle wholesalers must maintain extensive liability coverage and adhere to federal and state regulations.

- Cash Flow Gaps – Payment delays from dealerships and fleet customers can strain liquidity.

How SBA Loans Help Auto Wholesalers

SBA financing provides affordable, flexible capital that enables wholesalers to purchase vehicles, manage cash flow, and expand operations sustainably.

SBA 7(a) Loan

- Best for: Working capital, payroll, inventory purchases, or refinancing debt.

- Loan size: Up to $5 million.

- Why it helps: Provides liquidity for acquiring vehicles and managing day-to-day operations.

SBA 504 Loan

- Best for: Real estate and large-scale facility investments.

- Loan size: Up to $5.5 million.

- Why it helps: Ideal for building or upgrading warehouses, vehicle storage lots, or logistics hubs.

SBA Microloans

- Best for: Small or startup wholesalers.

- Loan size: Up to $50,000.

- Why it helps: Useful for small-scale inventory purchases, technology, or initial marketing expenses.

SBA Disaster Loans

- Best for: Wholesalers affected by natural disasters or economic disruptions.

- Loan size: Up to $2 million.

- Why it helps: Provides recovery funding for damaged inventory, facilities, or lost revenue.

Step-by-Step Guide to Getting an SBA Loan

- Check Eligibility – Must be a U.S.-based, for-profit wholesaler with good personal credit (typically 650+).

- Prepare Financial Documents – Include tax returns, P&L statements, supplier contracts, and vehicle inventory lists.

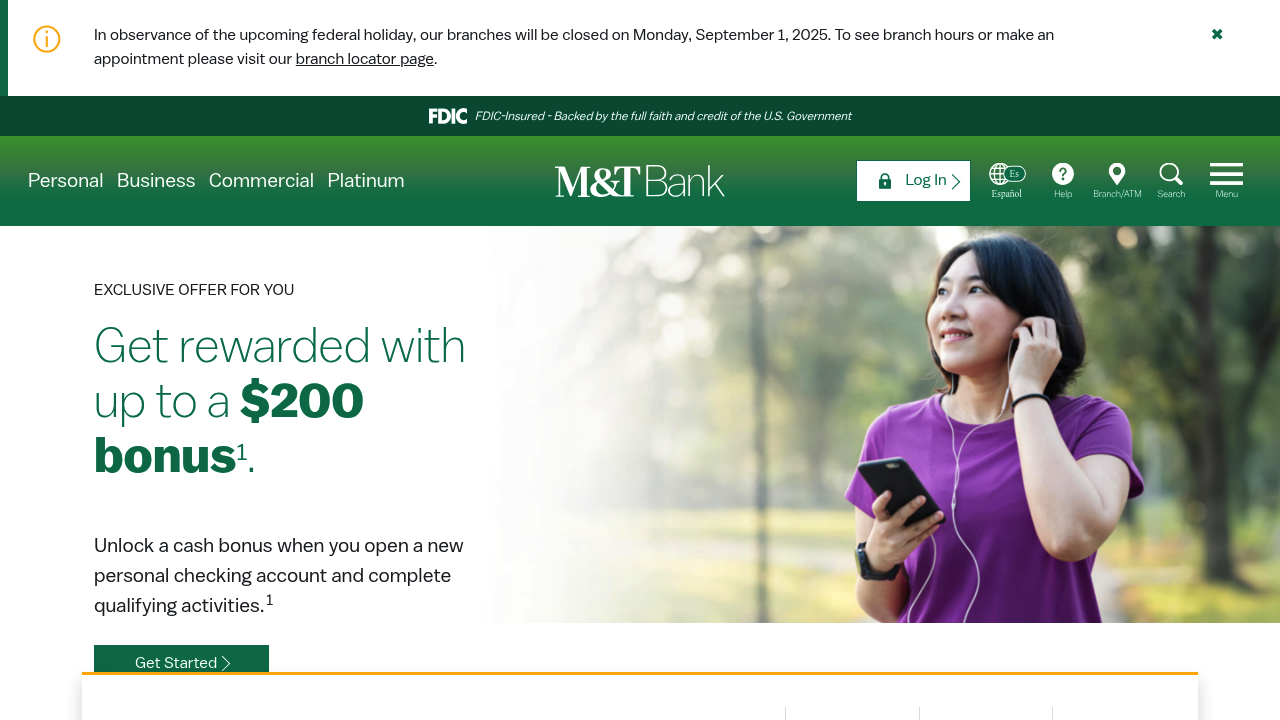

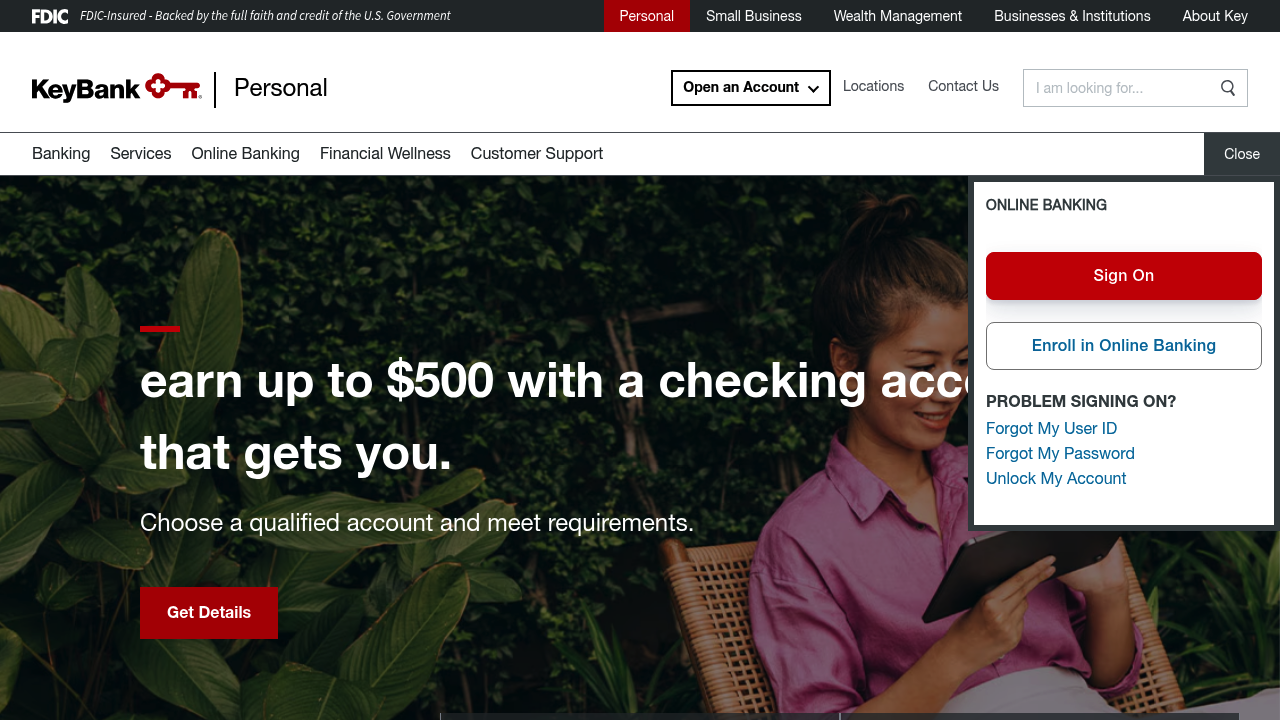

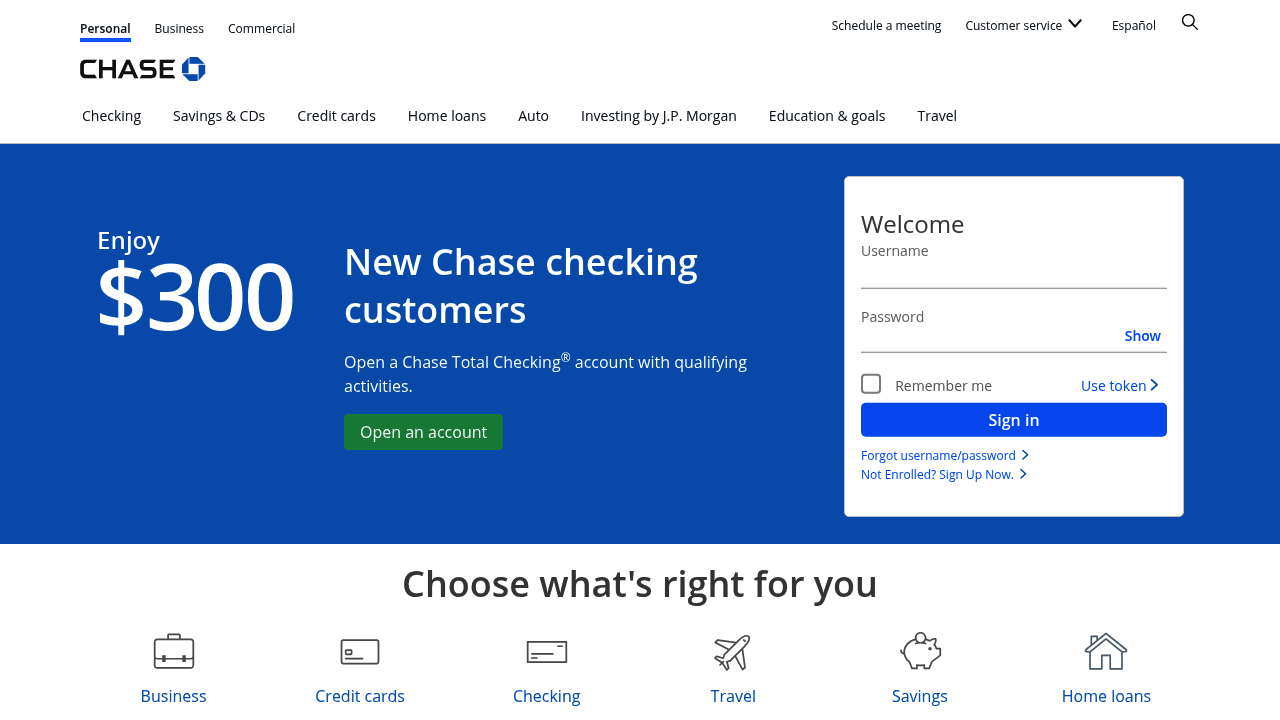

- Find an SBA-Approved Lender – Some lenders specialize in automotive and wholesale distribution financing.

- Submit Application – Provide a business plan highlighting inventory strategies, client base, and growth goals.

- Underwriting & Approval – SBA guarantees reduce lender risk. Approval usually takes 30–90 days.

FAQ: SBA Loans for Automobile and Motor Vehicle Wholesalers

Why do banks often deny loans to auto wholesalers?

Banks may see vehicle wholesalers as risky due to high inventory costs, market volatility, and potential depreciation. SBA guarantees reduce this risk and improve approval chances.

Can SBA loans finance vehicle inventory?

Yes. SBA 7(a) loans can be used to purchase vehicles for wholesale distribution, while 504 loans can fund storage facilities.

What down payment is required?

SBA loans usually require 10–20% down, compared to 25–30% for conventional loans.

Are startup wholesalers eligible?

Yes. Entrepreneurs with supplier agreements, dealership connections, and a strong business plan may qualify for SBA financing.

What repayment terms are available?

- Working capital: Up to 7 years

- Equipment/facilities: Up to 10 years

- Real estate/warehouses: Up to 25 years

Can SBA loans support expansion into new markets?

Absolutely. Many wholesalers use SBA loans to expand geographically, diversify inventory, and build stronger dealership networks.

Final Thoughts

The Automobile and Other Motor Vehicle Merchant Wholesalers sector is essential to the auto industry’s supply chain but faces steep financial barriers tied to inventory, logistics, and market volatility. SBA Loans for Auto Wholesalers provide affordable, flexible financing to stabilize operations, expand facilities, and purchase vehicles at scale.

Whether you’re an established wholesaler or a startup looking to break into vehicle distribution, SBA financing can provide the resources you need. Connect with an SBA-approved lender today and explore your funding options in the motor vehicle wholesale industry.

Filters

Tags

#Preferred Lenders Program

#SBA Express Program

#Existing or more than 2 years old

#Startup

#Loan Funds will Open Business

#Change of Ownership

#New Business or 2 years or less

#7a General

#Variable Rates

#Fixed Rates

#Asset Base Working Capital Line (CAPLine)

#International Trade Loans

#Export Express

#7a with WCP

#Contract Loan Line of Credit (CAPLine)

#7a with EWCP

#Preferred Lenders with WCP

#Preferred Lenders with EWCP

#Seasonal Line of Credit (CAPLine)

#Builders Line of Credit (CAPLine)