Find the best SBA Rates for your industry by searching our SBA Lender Directory

SBARates.com is a data-driven SBA lending intelligence platform. The site provides industry-specific lending insights, lender analytics, approval trends, and average SBA 7(a) loan rates to help entrepreneurs research SBA lenders and prepare for funding.

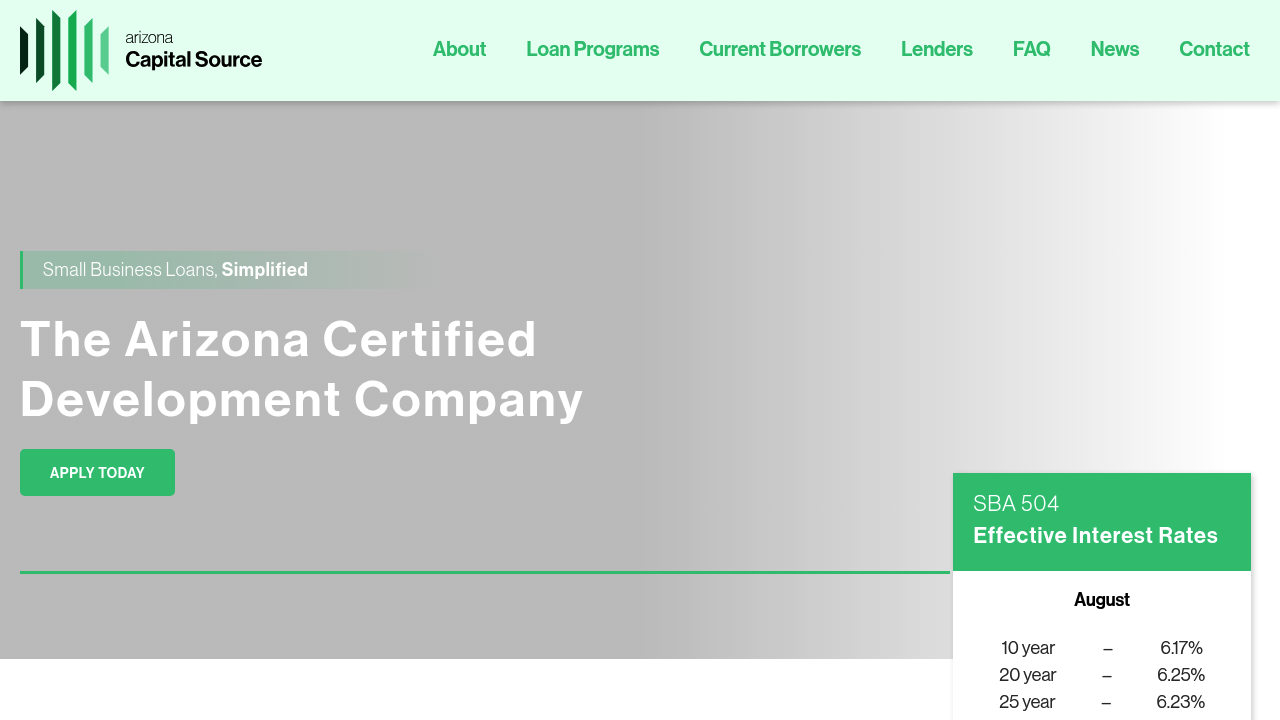

Arizona Capital Source (AZ)

Need funding for your business? Explore our SBA loan options at Arizona Capital Source and get the support you need to grow your business.

Unlock Your Business Potential with Arizona Capital Source

Are you looking for funding to take your business to the next level? Arizona Capital Source is here to help! Specializing in SBA loan options, we provide tailored financial solutions to support your business growth. With us, you can confidently access the funding you need to fuel your entrepreneurial dreams.

Why Choose Arizona Capital Source?

- Specialized SBA Loan Options: We offer a variety of Small Business Administration (SBA) loans designed to meet your unique financing needs.

- Expert Guidance: Our team of experienced professionals is dedicated to guiding you through the loan process every step of the way.

- Fast and Efficient Service: We prioritize quick and efficient processing, so you can get the funds you need without unnecessary delays.

- Customized Solutions: We work with you to create funding solutions that align with your business goals and financial situation.

At Arizona Capital Source, we're committed to being your partner in success. To learn more about our services and how we can assist your business, visit our website or contact us today! Let’s start building a brighter future for your business together.